Funeral Bond

Sureplan’s funeral bond is called Sureplan Gold and it is a conservatively managed bond that may be an ideal way with which to put aside funds for your funeral expense. You can either invest a lump sum or deposit regular or ad-hoc deposits from as little as $50. Therefore, it can be an ideal funeral saving plan.

As Sureplan Gold is a funeral bond, you will be unable to access your funds after the 30 day “cooling off” period.

Sureplan Gold has some important benefits over traditional savings and investment funds

You can contribute up to $15,000 (as at 1/7/2023) without it being subject to the Centrelink or Department of Veterans' Affairs Income and Assets Test – this is very relevant for self-funded retirees who are either receiving a part pension or who are just outside the pension entitlement threshold. For more information, click on the link below;

www.humanservices.gov.au/customer/enablers/funeral-bonds-and-prepaid-funerals

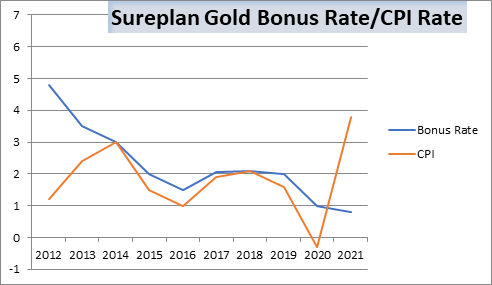

Recent Returns for Sureplan Gold Funeral Bond

| Year | Sureplan Gold Return | Annual CPI (Inflation) |

|---|---|---|

| 2011/12 | 4.80% p.a. | 1.20% p.a. |

| 2012/13 | 3.50% p.a. | 2.40% p.a. |

| 2013/14 | 3.00% p.a. | 3.00% p.a. |

| 2014/15 | 2.00% p.a. | 1.50% p.a. |

| 2015/16 | 1.50% p.a. | 1.00% p.a. |

| 2016/17 | 2.06% p.a. | 1.90% p.a. |

| 2017/18 | 2.10% p.a. | 2.10% p.a. |

| 2018/19 | 2.00% p.a. | 1.60% p.a. |

| 2019/20 | 1.00% p.a. | -0.30% p.a. |

| 2020/21 | 0.80% p.a. | 3.80% p.a. |

| Q1 |

How safe is my money with Sureplan?

Sureplan has been managing funeral funds since 1935 and has a long and proud history of delivering outstanding benefits for members. Your investment in Sureplan Gold is safeguarded by the solvency reserves maintained in accordance with the prudential standards issued by the Australian Prudential Regulation Authority (APRA). |

| Q2 |

Why should I deposit money in Sureplan Gold - funeral bond rather than simply putting money in a bank account?

The simple answer is convenience. When a member dies, we simply need to be advised of their death together with the name of the funeral director being used, and we will organise for the claim to be processed without the family needing to complete any paperwork. There are also other advantages for using Sureplan Gold for your funeral preplanning or prepaid funeral plans, including:

|

| Q3 |

How do I invest in Sureplan Gold?

Simply download the Sureplan Gold PDS and, if a Queensland resident, a Client Care Statement. Alternatively, call 1800 817 105 or email and we will post you the necessary documentation. You will need to complete the Application Form contained in the PDS and the front page of the Client Care Statement and forward them to Sureplan, Reply Paid 899, Spring Hill Qld 4004. |

| Q4 |

Can I withdraw money from my funeral bond?

No. After the cooling off period the benefit is only payable upon your death. |

| Q5 |

Who can join Sureplan Gold?

Anyone can join. There are no health conditions applicable to Sureplan Gold. |

| Q6 |

How much can I contribute and how many funeral bonds can I have?

There is no maximum contribution amount or number of funeral bonds that a member can use for their funeral cover. However for Centrelink and Veterans' Affairs pensioners to qualify for an exemption under the Incomes and Assets Test, your contribution to a funeral bond is subject to a Government threshold (see Pension Advantages for explanation) and you cannot have more than two funeral funding arrangements. Also, for tax purposes, the money contributed to all funeral funding arrangements must not exceed the amount that would reasonably cover a member's future funeral expenses. |

| Q7 |

What fees and charges do I pay?

None as an individual but the Fund pays a monthly Management Fee (maximum of 2% p.a. of the balance of the Fund) to the Sureplan Friendly Society Ltd General Fund to cover operating and administration costs. No fees come directly out of members' contributions. |

| Q8 |

Are there any Government charges?

Stamp duty may apply to your initial contribution and any subsequent contributions, or on assignment of your policy. The rate of stamp duty payable varies from State to State, and if payable, will be deducted from your contribution/s. |

| Q9 |

How is the benefit claimed and what evidence is needed to confirm my death?

Someone, ideally the nominee, needs to ring our office on 1800 817 105 to advise of your death. Sureplan requires independent evidence of your death from a third party (e.g. the Funeral Director). The Society reserves the right to sight a death certificate before paying the benefit. |

| Q10 |

Who pays tax?

Investment income earned by Sureplan on your investment in Sureplan Gold will be subject to tax in the hands of Sureplan, but when investment income is paid to nominees Sureplan may receive a tax deduction for that amount. This will mean that benefits paid by Sureplan may be effectively at their gross (or untaxed) value. The Board may declare a terminal bonus, based on taxable growth, payable in respect of claims paid in the twelve months following the annual 30 June actuarial valuation. The investment income or bonuses component of benefits received will be subject to tax in the hands of your estate in the year in which they are paid. Whether any actual tax is payable will depend on your estate's tax position in that year. Note though that the 'capital' component of benefits paid is simply a tax-free return of capital. It is recommended that appropriate and independent professional advice be sought to determine how tax laws may affect your individual circumstances, mindful that these laws may change from time to time. |

| Q11 |

Does my investment attract GST?

Under Australia's current Goods and Services Tax (GST) rules your contribution/s, investment earnings and benefit payments do not attract GST. |

| Q12 |

Does the Funeral Fund allow joint membership?

Yes, in accordance with the Fund rules. Please contact Sureplan Friendly Society Ltd for more information. |

Downloads

Download Sureplan Gold Application 1889K

Download Sureplan Gold Application 1889K

Download Direct Debit Authority 68K

Download Direct Debit Authority 68K

Download Client Care Statement 201K

(Queensland Residents Only)

Download Client Care Statement 201K

(Queensland Residents Only)

Download Change of Details Form 81K

Download Change of Details Form 81K